Sustainably growing a successful business means keeping tabs on things that are important to it. Unfortunately, many Philippine-based small businesses struggle to maintain accurate business records.

Accurate record-keeping is important for two crucial reasons. The first reason is so that you know how much to remit for proper tax compliance. The second more important reason is so that you have a good idea of the real state of your business’s finances, which should allow you to avoid unnecessary risks.

Thankfully, developing an effective financial record management system doesn’t have to be painful. Here are a few tips that should help you maintain accurate financial records in your small business:

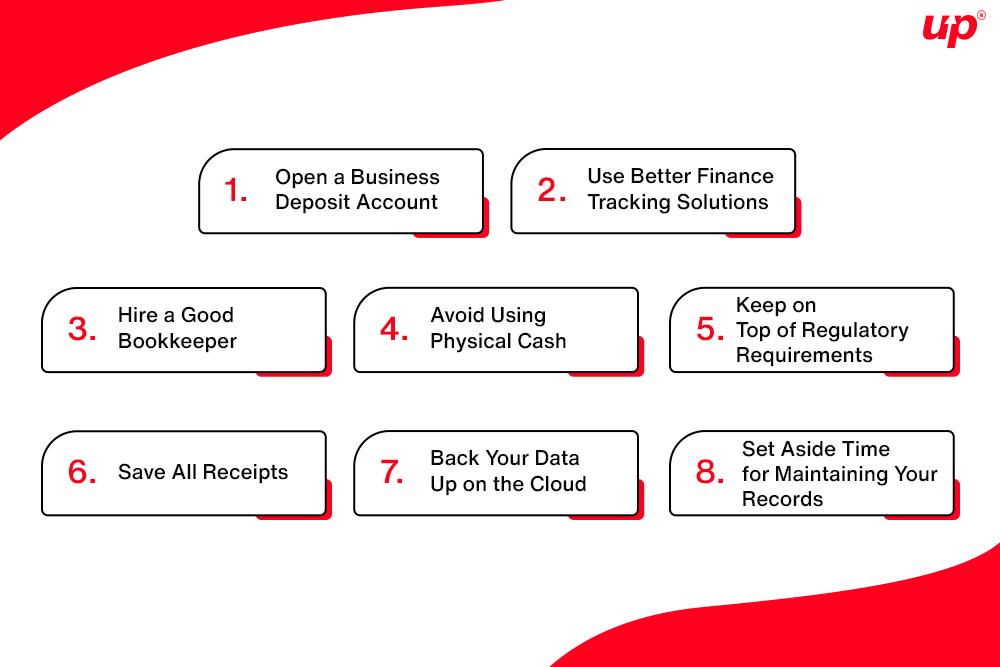

1) Open a Business Deposit Account

Opening a small business banking account at a reputable financial institution will not only grant you better visibility over your business’s finances, but it should also help separate your personal expenses from your business expenses, as well as legitimize your operations and open new doors for it in the future.

For financial control on the go, make sure to choose a savings product that offers intuitive online business banking. The Maya Business Deposit product is especially well-liked for small business banking online, thanks to the level of control and visibility available over the Maya Business Manager dashboard. The dashboard also lets you see loans, payments, and cash flow details from Maya Business, making it an effective all-in-one stop for assessing your business’s financial health.

2) Use Better Finance Tracking Solutions

Aside from online business banking, Philippines’ small businesses should also invest in accounting software or enterprise resource planning (ERP) solutions that seamlessly reconcile expenses related to all their operations. Integrating these automated solutions into your operations can remove much of the human labor involved in logging expenses, reducing losses due to errors and making audits a breeze.

3) Hire a Good Bookkeeper

Even the best accounting automation and ERP software is useless without smart bookkeepers and accountants to make sense of your transactions. Once you find a bookkeeper who can effectively interpret and categorize your financial data, be sure to do what you can to keep them on your payroll.

4) Avoid Using Physical Cash

Using physical cash for your business transactions can make it challenging to track and record expenses accurately. It’s harder to maintain a clear paper trail, and cash expenditures might get lost or forgotten.

Whenever possible, encourage digital payment methods like e-wallets and QR Ph codes. These methods not only provide better transparency but also allow you to better integrate transactions into your accounting software. And with the massive popularity of cashless transfers and domestic online business banking, Philippines’ consumers will need little convincing to use digital payments when dealing with your business.

5) Keep on Top of Regulatory Requirements

Staying compliant with relevant regulations and tax laws is crucial for any business. This involves understanding relevant requirements and deadlines for tax filings, licenses, permits, and reporting. Not complying with these regulations may not only lead to penalties and legal issues but a loss of confidence in your business. If Philippine tax laws are outside your wheelhouse, hire a tax professional or agency to ensure your business meets all its regulatory obligations.

6) Save All Receipts

Proper record-keeping not only aids in tracking expenses but also provides evidence in case of audits or disputes. Save all receipts, invoices, and documents related to your business’s transactions. In the Philippines, some financial statements need to be kept going back 10 years. Understandably, this can be tedious, particularly if you deal with a lot of cash transactions. Fortunately, digital storage and organization tools can help streamline this process.

7) Back Your Data Up on the Cloud

Having to keep 10 years’ worth of paper records is no easy task, especially in a place with harsh environmental conditions like the Philippines. Pest infestation, humidity, and natural disasters all present a risk to physical files, so you need to provide sufficient redundancy to safeguard your financial records.

Digitizing your records and storing them on the cloud not only helps protect them against these real-world threats but also ensures that they’re accessible from anywhere. Fortunately, leading cloud accounting and storage platforms are not only affordable but they also offer robust security measures to keep your data safe. Once you’ve chosen and implemented a backup solution, regularly upload copies of your financial data to effectively maintain business continuity.

8) Set Aside Time for Maintaining Your Records

Running a small business can be hectic, but you need to dedicate time to maintaining your financial records. Keeping a strict record maintenance schedule helps prevent backlogs and keeps your available financial information relevant. While you can automate some things with accounting software, regular manual checks will ensure smoother audits, better data visibility, and flawless compliance.

The importance of accurate financial record-keeping cannot be overstated. Though small businesses in the Philippines continue to face challenges in this area, you can make this part of doing business much less stressful with the tips above. And while putting things off can be all too tempting, just remember: the effort you put into maintaining your financial data today will keep your business running smoothly in the future.