Everything in the banking and finance sector has altered drastically as a result of the technological revolution and digitalization. The ecosystem becomes more convenient, secure, rapid and profitable to Fintech apps. Along with creating new prospects, it has had a big impact on other firms. Hence, the Finteach startups are focused on searching for Finance App Ideas to generate great revenue in the era of digitalization.

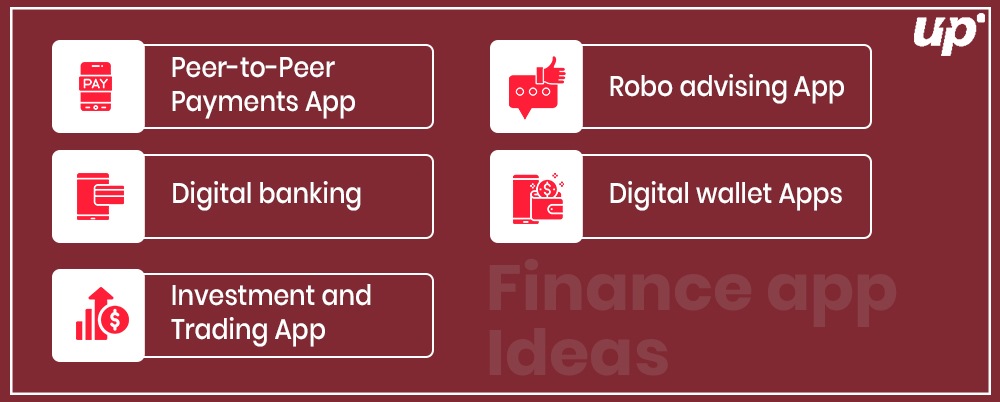

15 Best Finance app Ideas for Fintech Startups in 2022-

-

Peer-to-Peer Payments App:

Peer-to-peer payments solution (P2P Payments app) is one of the most promising Finance App Ideas for Fintech Startups in 2022. These types of apps allow users to send and receive money through the linked bank account or card without the involvement of a third party. P2Ppayments app is also known as the Money transfer app. Another advantage of these types of money transfer apps is that the users don’t need to disclose their bank details for the transaction. They can do the transaction by sharing their mobile number, username or Email address. The app only demands easy-to-use technologies with robust security.

Some popular money transfer apps are Google Pay, Venmo and Paypal.

As per the Allied Market Research Report, the global P2P payment sector is expected to generate $9,097.06 billion in sales by 2030 from $1,889.16 billion in revenue in 2020.

A right Payment App Development Company in India can help you in developing such app for your startups.

2. Digital banking:

Creating Digital banking apps is one of the best Fintech App Ideas at present time. People are using such apps for doing all the banking activities like investing funds, opening an account, transferring money, paying the bill, accessing transaction history or account balance and blocking and unblocking cards etc. with a few taps on their mobile. The craze for mobile banking is incredibly increasing after the Covid-19 pandemic. But, you have to bolster the security measures of such types of apps to protect the users’ money from the expanding threat of online phishing scams. Popular digital banking apps are HSBC mobile banking, Payzapp apps.

An economic survey shows that approximately 97 per cent population of millennials are currently using mobile banking apps and 89 per cent of all customers are utilizing these apps for many financial management tasks.

3. Investment and Trading App:

Many people are fond of trading and investing in stocks. What about giving them a strong platform for managing their investment? Developing such an investment and trading app that can manage stocks, equity funds, shares, and crypto assets all at once, can bring your company into Limelight. But, you have to use some modern technologies like AI/ML and tight cyber security tools to provide the users with a scalable and secure app to monitor the funds, compare data from different sources and predict the prices of trading assets easily.

Renowned Demat app- SoFi

The number of active Demat accounts has jumped from 63 per cent to 89.7 million in the last 12 months. Hence, if you think to develop such a unique app for your company, you should contact a Payment App Development Company in India.

4. Robo advising App:

Developing a Robo-advising is one of the most effective Fintech App Ideas to attract millennials to the start-ups. The app is driven by machine-learning software with less human interaction. These types of apps provide the most tailored financial guidance for investment based on the market future at a very low cost. The Robo–Advisors sector is projected to reach US$1.66tn in 2022 and grow at a CAGR of 31.8% from 2020 to 2027. If you want to generate high revenue from such Fintech app, go to an Android App Development Company who are popular in making apps with emerging technologies.

Popular Robo advisor app- Wealthfront.

5. Digital wallet Apps:

Creating an app like a Digital wallet or Ewallet/Mwallet is one of the most grounded Fintech App Ideas. These types of apps are like physical wallets where you can store all your digital payment methods. Users can make payments through the app without credit or debit cards and get many offers like cash back, discounts, etc… The digital wallet market is now flourishing and it is assumed that it will reach $7581 billion by the year 2024.

If you want to create a unique Digital wallet app by enhanching security with easy-to-use user interaction, consult with a top-notch Payment App Development Company in India.

Well-known Ewallet- Google wallet

6. Insurtech apps

Insurtech apps are such Fintech apps that integrate modern technologies like IoT, AI/ML and data science with insurance policy management. They provide real-time data about the latest insurance policies, and apparent risks and manage customers’ policies and their premium payments.

The global market size nsurtech was t USD 3.85 billion in 2021 and it is predicted that it will be extended at a CAGR of 51.7% from 2022 to 2030. The booming market of Insutech apps shows that it’s one of the most profitable Finance App Ideas in the recent world. Hiring a robust Android App Development Company for developing such apps, could be a wise decision for your startups.

Relevant example: Kakau.

7. Loan and Credit App:

Investing in loan lending apps is one of the most exciting Finance app ideas for Fintech startups. These types of fintech apps create a direct connection between the borrowers and the lenders without any financial intermediary. It accelerates the lengthy process of loan lending at a cheap interest rate.

The global market size of P2P lending was valued at US$ 83.79 billion in 2021 and it is speculated that it’ll hit over US$ 705.81 billion by 2030. So, building a unique P2P lending app can bring a huge profit for your business if you consult with any top-notch Payment App Development Company in India.

Relevant application: Lendingkart

Source: Corporate Finance Institute

8. Financial record maintenance apps

Marinating personal finance or keeping track of all the financial data for a small-scale business is a difficult task. If you bring some financial records and maintain an ace app that can manage users’ income, and expenses data in real-time and helps them to get a better understanding to control their finance, will be a wise move for your startup. These types of apps are very efficient and user-friendly for small-scale businesses to keep track of their earnings, and investments, send payment reminders to customers, making tax invoices and other financial records.

The way, small businesses are growing and the demand for managing personal finance is increasing, these types of Fintech apps always earn profit. Hence, the idea of developing financial record management apps is the most beneficial among the other Finance App Ideas. If you plan for making such apps, you need to contact a top-grade Android App Development Company.

Popular apps in this field- Mint, Personal Capital, Vyapar

9. RegTech App:

Developing RegTech apps idea is falling under the sophisticated Fintech App Ideas for the startups. These types of apps help financial organizations stick on with all the local and international regulations. They also offer an automated process for identifying and verifying customer details, preparing and compiling reports, monitoring and reporting transactions and so on, while also increasing client retention rate.

As per the Markets and Markets forecast the global RegTech Market size will grow from USD 7.6 billion in 2021 to USD 19.5 billion by 2026, at a CAGR of 20.8% during the forecast period.

So, if you want to invest in such Fintech app, you must have to consult with a good Payment App Development Company in India.

10. Blockchain Applications:

The mobile application by using blockchain technology brings a transformation to the Fintech industry. Blockchain technology is vastly used in Cryptocurrency related apps that demand top-level security. This technology also leverages digital banking and other financial transactions. So, considering this idea of developing blockchain apps for starting a Fintech company is undoubtedly a profitable idea among the other Fintech App Ideas.

It is expected that global blockchain technology will be increased from USD 5.92 billion in 2021 to USD 10.02 billion in 2022. So, it’ll be a wise step for you, if you go to a top-notch Payment App Development Company in India for making such apps for your business.

11. Crowdfunding Solution

Crowdfunding is an emerging financing model for raising funds for entrepreneurs for their existing and new projects. It is the joint venture of the capitalists and various individuals. Hence, the idea of developing an app on this new financing model is one of the most successful Fintech App Ideas.

The concept of crowdfunding is extremely popular in both the US as well as UK regions. It is expected that the expanding market size of these types of mobile solutions will reach US$ 28.8 Bn by the year 2025.

Indiegogo or Kickstarter is a handful of crowdfunding platforms.

You can customize the idea of making a crowdfunding app when you come in contact with a great Android App Development Company.

12. Crypto Exchange Platform:

Cryptocurrencies have exploded in popularity in present days with the inclusion of Bitcoin and Ethereum Crypto exchanges. This platform captures $324.7 billion in the market consisting of 7,812 different cryptocurrencies. So, the idea of investing in applications related to crypto exchange platforms like Coinbase, and Binance is one of the most profitable Fintech App Ideas.

These apps allow users to trade cryptocurrencies for other assets such as fiat money or other digital currencies, helping them to participate in the decentralized market.

A reputed Payment App Development Company in India can develop a unique crypto exchange app by using emerging technology for your startups.

13. E-mortgage Apps:

One of the great Fintech App Ideas that emerged after the COVID-19 outbreak is the idea of creating E-mortgage apps. These electronic loan apps restructure the entire home loan application process in a simple, straightforward and hassle-free.

People are accepting the switch to online mortgage applications, too. It is speculated that the global e-Mortgage will expand at 18.2% CAGR reaching a valuation of US$ 46.2 billion by 2032.

So, if you think to develop such a revolutionary app for your startup, you need to check out a good Android App Development Company.

Popular Emorgage apps- Ez

14. Payday Loan Apps:

This is also a money lending app, but the difference is the lenders automatically deduct your money from your paycheck. They lend the customers a certain amount of money to aid them in their needs like paying hospital bills, EMI, etc…The users just need to add the information about their job and link it to the bank account.

Creating this type of unique app is one of the strongest Finance App Ideas for Fintech startups.

Brigit is one of the popular Payday loan apps in recent days.

The market size of these apps is projected to reach $ 48.68 bn by 2030 if it grows at a CAGR of 4.2% from 2021 to 2030.

15. Bill reminder apps:

The bill-reminder apps are effective bill-saving tools for those who frequently forget or are unable to pay their electric or water bills, Post-paid phone bills, Credit card payments and many other bills on time and as a consequence, they have to pay late charges without a valid reason. The apps provide a robust reminder for paying the bill and gives analytical tools to organize the bills.

These types of apps are very handy in recent times as people are doing all payments in digital mode. Thus, developing an app based on this idea could be a great move for Fintech startups. A genuine Payment App Development Company in India can help you to develop such a Fintech app for your business.

A good example of this app is Bills Monitor Pro.

Trending technologies for FinTech apps in 2022

The following are the supporting pillars of fintech applications that are driving it forward:

- AI/ML – It helps in identifying scrupulous activities and offers customized financial advice.

- IoT – It leverages the power of interconnected devices to the Internet; this unique solution helps in gathering real-time data and assists with improved decision making.

- Blockchain – Blockchain provides fast and secure transactions.

- Big Data – This can help in analyzing market trends, and interpreting customer behaviour and large volumes of data.

- Cybersecurity – Security is indispensable for Fintech apps. Thus, Source Code Analytics, DevSecOps, and many other advanced technologies play a key role in securing people’s money and data.

Final Thoughts:

The way the global FinTech market is expanding, it is expected that by the end of the year 2022, it might reach a worth of $309.98 billion. The adoption of technology in the finance area offers several perks and the best thing is that they are giving access to financial services to billions of users.

Now, these top 15 Fintech app ideas will help your startup to generate a profitable app. However, just having a great startup idea is not effective for a successful startup. You need to consult with the right Payment App Development Company in India to develop a profitable Fintech app for your Startups.